☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under | |

☒ | No fee required. | |||

☐ | ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| Fee paid previously with preliminary materials. | ||||

☐ | ||||

TALOS ENERGY 2024 PROXY STATEMENT

Talos Energy Inc.’s 2024 Annual Meeting of Stockholders Information

|

10:00 a.m. | |||||||||||||||

Central time |

| |||||||||||||||

| ||||||||||||||||

| Date | |||||||||||||||

|

May

|  | Place Three Allen Center 333 Clay Street, Suite 3300 Houston, Texas 77002 |  | Record Date April 3, 2024 | ||||

ToVoting Methods

Even if you plan to attend the stockholders of Talos Energy Inc.:

Notice is hereby given that the 2019 Annual Meeting of Stockholders of Talos Energy Inc. (the “Company”) will be held at Three Allen Center, 333 Clay Street, Suite 3300, Houston, Texas 77002, on May 6, 2019, at 10:30 a.m., Central Time (the2024 annual meeting of stockholders (including any adjournment or postponement thereof, the “Annual Meeting”). The Annual Meeting is being held for in person, we urge you to vote in advance of the following purposes:meeting using one of these advance voting methods.

www.proxydocs.com/TALO | ||||

1-866-291-6999 | ||||

| ||||

| ||||

P.O. Box 8016 | Cary, NC 27512-9903 | |||

Each outstanding share of the Company’s common stock (NYSE: TALO) entitles the holder of record at the close of business on March 11, 2019, to receive notice of and to vote at the Annual Meeting or any adjournments or postponements of the Annual Meeting.

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, WE URGE YOU TO VOTE YOUR SHARES BY INTERNET, BY TELEPHONE, OR BY SIGNING, DATING AND RETURNING THE PROXY CARD YOU WILL RECEIVE. IF YOU CHOOSE TO ATTEND THE ANNUAL MEETING, YOU MAY STILL VOTE YOUR SHARES IN PERSON, EVEN THOUGH YOU HAVE PREVIOUSLY VOTED OR RETURNED YOUR PROXY BY ANY OF THE METHODS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT. IF YOUR SHARES ARE HELD IN A BANK OR BROKERAGE ACCOUNT, PLEASE REFER TO THE MATERIALS PROVIDED BY YOUR BANK OR BROKER FOR VOTING INSTRUCTIONS.

The Annual Meeting is being held for the following purposes:

Matter | Page Reference (For More Detail) | |||

| 1 | To elect to the Company’s Board of Directors the three Class III director nominees, set forth in the accompanying Proxy Statement, each of whom will hold office until the next annual meeting of stockholders and until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. | 6 | ||

| 2 | To approve, on a non-binding advisory basis, the Company’s Named Executive Officer compensation for the fiscal year ended December 31, 2023. | 64 | ||

| 3 | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. | 66 | ||

| 4 | To approve the Amended and Restated Talos Energy Inc. 2021 Long Term Incentive Plan (the “Amended 2021 LTIP”). | 68 | ||

| 5 | To approve a Certificate of Amendment to the Company’s Second Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation (the “Exculpation Amendment”). | 78 | ||

| 6 | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. | |||

Each outstanding share of common stock, par value $0.01 per share (“common stock”) of Talos Energy Inc. (NYSE: TALO), entitles the holder of record at the close of business on April 3, 2024 to receive notice of and to vote at the Annual Meeting or any adjournments or postponements of the Annual Meeting.

ALL STOCKHOLDERS ARE EXTENDED A CORDIAL INVITATION TO ATTEND THE ANNUAL MEETING.

By order of the Board of Directors,

| ||

|

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDERANNUAL MEETING TO BE HELD ON MAY 6, 2019:23, 2024: THIS PROXY STATEMENT, THE PROXY CARD AND OUR ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023 ARE AVAILABLE AT WWW.INVESTORVOTE.COM/WWW.PROXYDOCS.COM/TALO.

TABLE OF CONTENTS

ROAD MAP OF VOTING ITEMS

ABOUT TALOS ENERGY INC. Headquartered in Houston, Texas, Talos Energy Inc. is a leading independent offshore exploration and production (“E&P”) company with operations in the U.S. Gulf of Mexico and offshore Mexico. Talos became a public company in May 2018 following its business combination with Stone Energy Corporation, transitioning from a private company with five original employees in 2012 to over 700 employees after our acquisition of QuarterNorth Energy Inc. (“QuarterNorth”) in March 2024. Since its founding over a decade ago, Talos has maintained its entrepreneurial spirit while growing to become the fifth largest operator on a combined Talos/QuarterNorth basis in the Gulf of Mexico offshore basin. We take pride in leveraging our technical and operational expertise to acquire, explore and develop offshore assets in order to provide responsibly-produced energy with a commitment to safe and efficient operations, environmental responsibility, and good governance and ethics. Areas of Operation

PROXY STATEMENT SUMMARY This summary highlights information that

2024 Annual Meeting Time and Location: Three Allen Center, 333 Clay Street, Suite 3300, Houston, Texas 77002 Record Date: Wednesday, April 3, 2024 Voting: In accordance with the Company’s Second Amended and Restated Certificate of Incorporation, each share of our common stock, par value $0.01 per share (“common stock”), is entitled to one vote for each proposal to be voted on. Materials: Our proxy Voting Matters and Board Recommendations The Board recommends that you vote on the various proposals as indicated in the “Road Map of Voting Items” on page i. Questions and Answers about the Meeting Please see “Questions and Answers About the Annual Meeting” beginning on page 86 for additional information about the proxy materials, the Annual Meeting and Board of Directors and Director Nominees Independent Board: Our Board is comprised of a majority of independent directors. Non-Executive Chairman of the

Proxy Statement Summary Director Nominees: The Company has proposed the following three (3) director nominees for election to the Board at the Annual Meeting,

Other Directors: The Company’s other directors include:

Proxy Statement Summary Standing Committees of the

Independent Board Committees: Each of the Board’s committees is composed entirely of independent directors. Board Committee Membership: The following table below provides for the current members and chairpersons of each standing committee of the Board.

Please see “Governance and Board Matters—Committees of the Board” for additional information regarding our Board’s standing committees.

Proxy Statement Summary Board and Governance Practices and Highlights The Company is committed to good corporate governance as part of our

The Board proactively reviews the Company’s corporate governance policies and considers corporate governance issues and feedback from our stockholders and other key stakeholders. Examples of recent changes in corporate governance practices include:

PROPOSAL

At the recommendation of the

Each of the directors nominated by the Board has consented to serving as a director nominee, being named in this Proxy Statement, and serving on the Board if elected. Each director elected at the Annual Meeting will be elected to serve On January 13, 2024, we executed a merger agreement to acquire QuarterNorth, a privately-held U.S. Gulf of Mexico E&P company (such acquisition, the “QuarterNorth Acquisition,” and such agreement, the “QuarterNorth Merger Agreement”). Pursuant to the QuarterNorth Merger Agreement, we (a) increased our Board size from eight (8) to nine (9) members and (b) appointed QuarterNorth’s Board designee, Mr. Mr. Mills was appointed to serve until the 2024 Annual Meeting of Stockholders or until his successor is elected and qualified, or, if earlier, until his respective death, disability, resignation, disqualification or removal from office. Mr. Goldman, Ms. Glover and Mr. Mills are each designated as a Class III director and assuming the stockholders elect them to the Board, their one-year term of office will expire in 2025. Messrs. Duncan, Sledge,

The Board of Directors has no reason to believe that its director nominees will be unable or unwilling to serve if elected. If a director nominee becomes unable or unwilling to accept nomination or election, the persons acting under your proxy will vote for the election of a substitute nominee, if any, that the Board of Directors recommends.

Vote Required The election of each nominee for director in this Proposal For this Proposal 1, a “majority of the Abstentions and brokernon-votes with respect to this proposal are not treated as votes cast and, therefore, will have Recommendation

GOVERNANCE AND BOARD MATTERS Board Composition Set forth below is biographical information about each of our current directors and our director nominees.

Governance and Board Matters

Governance and Board Matters

Governance and Board Matters

Governance and Board Matters

Governance and Board Matters

Governance and Board Matters

Governance and Board Matters Director Independence Assuming the stockholders elect to the Board of Directors the director nominees set forth in “Proposal

On February 13, 2023, in connection with the closing of our acquisition of EnVen Energy Corporation (“EnVen” and such acquisition, the “EnVen Acquisition”) and the related termination of the Stockholders’ Agreement (as defined herein), Robert M. Tichio resigned from the Board of Directors and each of Ms. Szabo and Mr. Sherrill were appointed to the Board of Directors. At such time, the Board of Directors determined that each of Mr. Sherrill and Ms. Szabo were “independent” pursuant to NYSE rules and were assigned their respective committees based on such determination. See “Certain Relationships and Related Party Transactions—Historical Transactions with Affiliates—Stockholders’ Agreement” for additional information. On October 30, 2023, the Board of Directors deferred a determination of Mr. Sherrill’s independence due to his new role as President of Howard Low Carbon Solutions, an affiliate of Howard Energy Partners, a co-member in our Coastal Bend LLC (“Coastal Bend”) carbon capture and sequestration (“CCS”) project in Corpus Christi, Texas. Accordingly, Mr. Sherrill stepped down from the Audit Committee and Compensation Committee on October 30, 2023 and each of Mr. Juneau and Mr. Sledge replaced Mr. Sherrill on the Audit Committee and Compensation Committee, respectively. On March 18, 2024, Talos sold its entire CCS business, including Coastal Bend. On March 26, 2024, in light of the sale of the Company’s CCS business, the Board reaffirmed that Mr. Sherrill was “independent” pursuant to NYSE rules. On March 4, 2024, in connection with the closing of the QuarterNorth Acquisition, Mr. Mills was appointed to the Board of Directors to serve until the Annual Meeting. On March 26, 2024, the Board determined that Mr. Mills was “independent” pursuant to NYSE rules. The Board anticipates appointing Messrs. Mills and Sherrill to committees in connection with the Board’s annual evaluation of committee membership and structure. In connection with its assessment of the independence of each non-management director, the Board of Directors also determined that:

Governance and Board Matters Qualifications, Skills and Experience of Our Directors & Director Nominees We believe the members of our Board possess a broad variety of personal attributes, experience and skills giving our Board the depth and breadth necessary to effectively oversee management on behalf of our stockholders. Our Board is committed to diversity and the importance of different backgrounds, perspectives and views. The matrix below represents some of the key skills that our Board has identified as particularly valuable to the effective oversight of the Company and the execution of our corporate strategy. The matrix does not include all knowledge, skills, experience or other attributes of our directors and director nominees, which may be relevant and valuable to their service on our Board. The diversity of knowledge, skill, experience and attributes of our directors and director nominees, collectively, lends itself to a highly collaborative and effective Board. QUALIFICATIONS AND EXPERIENCE OUT OF 9 DIRECTORS

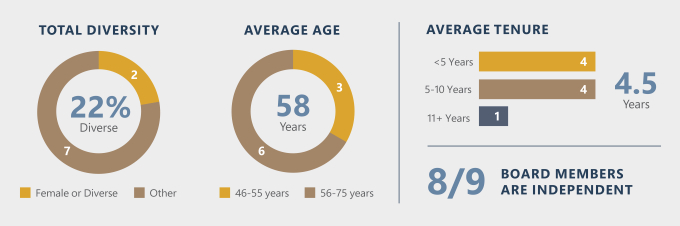

Board Diversity Our Board seeks to consider women and underrepresented director candidates for membership on the Board. Consistent with our ongoing commitment to creating a balanced Board with diverse viewpoints and deep industry expertise, our Board will continue to maintain its commitment to seeking diverse perspectives and experiences when evaluating nominees to the Board.

Governance and Board Matters COMMITTEES OF THE BOARD Overview of Responsibilities of our Board’s Standing Committees

Non-Standing Committees: From time to time, the Board may designate various non-standing special committees such as the CCS Investment Committee which was formed in February 2023 with specific authority to review and recommend strategic transactions with respect to CCS matters and/or transactions. Each of Messrs. Goldman, Kendall and Sledge currently serve on the CCS Investment Committee.

Governance and Board Matters AUDIT COMMITTEE

Financial Literacy of Audit Committee and Designation of Financial Experts The Board of Directors evaluated each of the members of the Audit Committee for financial literacy and the attributes of a financial expert. On February 13, 2023, the Board of Directors determined that each of the Audit Committee members, Messrs. Kendall, Sledge and Sherrill, is financially literate and is an “audit committee financial expert” as defined by the SEC for the fiscal year ended December 31, 2023. On October 30, 2023, the Board of Directors reaffirmed that Mr. Juneau is financially literate and is an “audit committee financial expert” as defined by the SEC.

Governance and Board Matters COMPENSATION COMMITTEE

Governance and Board Matters NOMINATING & GOVERNANCE COMMITTEE

Governance and Board Matters SAFETY, SUSTAINABILITY AND CORPORATE RESPONSIBILITY COMMITTEE

TECHNICAL COMMITTEE

Governance and Board Matters Annual Board Evaluations and Charter Reviews The Board conducts annual performance evaluations to determine whether the Board and its committees are functioning effectively. In addition, each standing committee evaluates its performance annually and recommends any changes to the Board. The Company’s secretary oversees the annual review and each committee’s Chair facilitates reporting results to the committees and full Board. Each standing committee operates under a written charter adopted by the Board, which the applicable committee reviews and evaluates at least annually. If a committee deems it to be appropriate, the committee may amend, or recommend to the full Board amendments to, such committee’s charter. Board Oversight of Risk Management

Enterprise Risk Management Effective risk oversight is a priority of the Board. Executive management is responsible for the day-to-day management of Company risks through internal processes and controls, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In connection with its oversight, the Board as a whole oversees the Company’s assessment of major risks and the measures taken to manage such risks. For example, the Board of Directors:

Governance and Board Matters

Audit Committee. The Audit Committee oversees the Company’s enterprise risk management framework and policies and procedures for risk assessment and risk management, and the Company’s major financial risks, major legal regulatory and compliance risks and major cybersecurity risks. The Audit Committee additionally oversees the work of, and relationship with, the independent registered public accounting firm, the Company’s financial statements and related disclosure and the Company’s internal audit function and related party transactions. Compensation Committee. The Compensation Committee exercises oversight of all matters of executive compensation policy, including the Company’s plans, policies and programs to compensate the Company’s employees, including with respect to management and mitigation of compensation-related risks and the administration of the Company’s Clawback Policy (as described below) and compliance with applicable rules and regulations pertaining thereto. Nominating & Governance Committee. The Nominating & Governance Committee oversees the nomination of director candidates, including the skills, qualifications and criteria related thereto, the Company’s succession planning, the Company’s corporate governance practices in accordance with the Company’s Corporate Governance Guidelines, and the Company’s compliance programs and policies, including the Company’s Code of Business Conduct and Ethics. SSCR Committee. The SSCR Committee oversees the Company’s strategies, policies and procedures for addressing Safety and environmental (including sustainability and climate change), social (including diversity, equity and inclusion) and other CSR matters. Technical Committee. The Technical Committee oversees the Company’s portfolio development and the evaluation of the Company’s oil, natural gas and natural gas liquids reserves. DIRECTOR ATTENDANCE Board and Committee Meetings The Board held eighteen (18) meetings consisting of four (4) regular and fourteen (14) special meetings during 2023. During the fiscal year ended December 31, 2023, each director attended at least 75% of the aggregate total number of Board and applicable Board committee meetings on which such director sits. 2023 Annual Meeting of Stockholders Under our Corporate Governance Guidelines, our directors are encouraged to attend our annual meeting of stockholders. 100% of our then-serving directors attended the 2023 Annual Meeting of Stockholders. We anticipate that all of our directors will attend this upcoming Annual Meeting. Executive Sessions The Board of Directors CORPORATE GOVERNANCE Corporate Governance Guidelines The Board of Directors believes that sound governance practices and policies provide an important framework to assist it in fulfilling its duty to stockholders. The Company’s “Corporate Governance Guidelines” cover the following subjects, among others:

Governance and Board Matters

The Corporate Governance Guidelines are posted on the Company’s website at www.talosenergy.com. The Corporate Governance Guidelines are reviewed periodically and as necessary by the Company’s Nominating & Governance Committee, and any proposed additions to or amendments of the Corporate Governance Guidelines will be presented to the Board of Directors for its approval. The NYSE has adopted rules that require listed companies to adopt governance guidelines covering certain matters. The Company believes that the Corporate Governance Guidelines comply with the NYSE rules. Board Leadership One of the Board’s responsibilities is to provide leadership to the Company and independent oversight of management. The Board understands that the optimal Board leadership structure may vary as circumstances warrant. Consistent with this understanding, the Nominating & Governance Committee considers the Board’s leadership structure periodically. Our Second Amended and Restated Bylaws provide that the Chairman of the Board may be any director elected by a majority of the Board. On May 10, 2023, Neal P. Goldman was re-elected as Chairman of the Board. At this time, the Board believes that separating of the roles of Chairman of the Board and the Chief Executive Officer provides the optimal Board leadership structure for us because it balances the needs for the Chief Executive Officer to manage the Company’s operations with the benefit provided to the Company by the Chairman’s perspective as an independent member of the Board. The Corporate Governance Guidelines require that the Chairman of the Board, if he or she is a non-management director, will be the “lead director” responsible for preparing an agenda for the meetings of the non-management directors in executive session. In the event the Chairman of the Board is a member of management, a lead director will be chosen by the non-management members of the Board. Mr. Goldman, the current Chairman of the Board, is a non-management director and therefore serves as lead director of the Board. Declassified Board Structure by 2025

Governance and Board Matters Beginning at the 2025 Annual Meeting of Stockholders, the Board of Directors will be fully declassified, with all directors up for re-election on an annual basis for a one-year term thereafter. The Board of Directors determined that a declassified board structure is appropriate for the Company, with such declassification occurring in stages beginning with the 2023 Annual Meeting of Stockholders and that annual voting on director nominees provides stockholders with a more active voice in shaping the composition of the Board and implementing corporate governance policies. As part of the transition to a declassified board structure at the 2025 Annual Meeting of Stockholders, the Board of Directors is currently divided into three classes serving staggered three-year terms. In connection with the QuarterNorth Acquisition, Mr. Mills, in his capacity as BOARD EVOLUTION

Our Board is committed to maintaining a composition that includes a range of expertise aligned with our business as well as a fresh perspective on our strategy. One of the ways the Board acts on this commitment is through the thoughtful refreshment of directors when appropriate. The Board has a process to seek out highly qualified director candidates who would bring relevant experience to the Board in light of our strategy, including with respect to our growing scale. Since 2021, we have added four directors to our Board of Directors, of which three were recently added to our Board pursuant to applicable Board designation rights. See “Certain Relationships and Related Party Transactions—Board Designation Rights” for additional information.

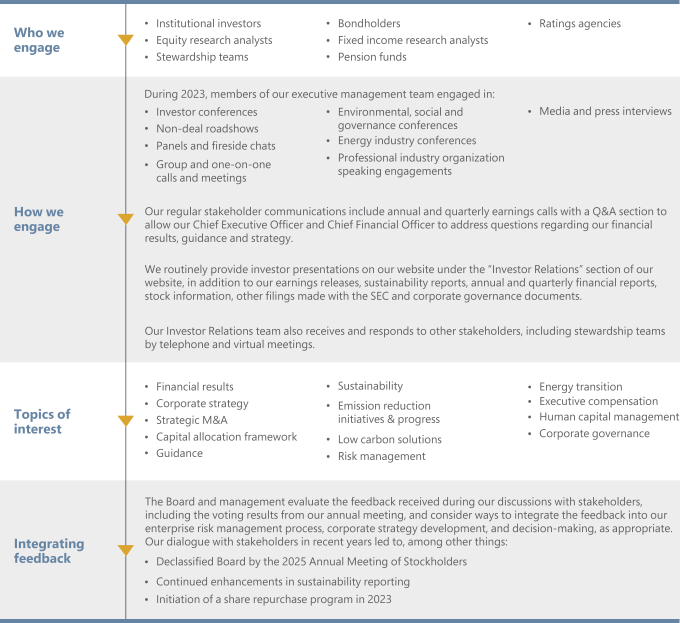

Governance and Board Matters Stakeholder Engagement To foster ongoing dialogue and build relationships, we proactively engage with and obtain feedback from our stakeholders throughout the year to help identify the emerging issues our stakeholders consider to be most important when evaluating our company. We seek opportunities to discuss and solicit stakeholder views on our strategy, business, corporate governance, executive compensation, sustainability and other topics of concern. The feedback we receive helps broaden our perspective, shape business and governance decisions, and align with stakeholder expectations, as appropriate.

Governance and Board Matters Director Compensation Non-employee director compensation elements are designed to:

Non-employee director compensation levels are reviewed by the Compensation Committee each year, and resulting recommendations are presented to the full Board for approval. The Compensation Committee’s independent compensation consultant provides information on current developments and practices in director compensation. The Compensation Committee utilizes the same independent compensation consultant retained by the committee to advise on executive compensation to provide this analysis regarding director compensation. The non-employee director compensation program includes:

The tables below set forth the 2023 compensation program for our non-employee directors.

Governance and Board Matters Directors also received supplemental cash retainers for service on Board committees in the following amounts during 2023:

Each non-employee director may additionally receive $1,500 for each meeting of the Board or a committee (other than the CCS Investment Committee) above 10 meetings (both in-person and telephonic). Each director is also reimbursed for reasonable travel and miscellaneous expenses incurred to attend meetings and activities of the Board and the committees. Our Non-Executive Chairman participates in our medical and dental plans but pays the full cost of the premiums out of pocket. In accordance with our non-employee director compensation program, we granted RSUs to each non-employee director on March 5, 2023, which vested in full on March 5, 2024, subject to the non-employee director’s continued service. In the year prior to grant, each non-employee director was provided the opportunity to defer the settlement of their RSUs until a later date, as timely selected pursuant to the deferral election form. Following the vesting date, or such later date as elected by the director pursuant to the deferral election, these RSUs are settled 60% in shares of our common stock and 40% in cash, unless the director timely elects for the awards to be settled 100% in shares of our common stock. Vesting of the RSUs will accelerate in full upon (i) a termination of the non-employee director’s service due to death or (ii) a “change in control” (as defined in the applicable long-term incentive plan). Our non-employee directors are also subject to the Talos Energy Inc. Stock Ownership Policy (the “Stock Ownership Policy”), as further described below under “Executive Compensation Matters—Compensation Discussion and Analysis—Other Matters—Stock Ownership Policy.”

Governance and Board Matters 2023 DIRECTOR COMPENSATION TABLE The table below reflects the cash compensation earned during 2023 and the value of RSUs granted during 2023 by the members of the Board that are compensated by us for their service on the Board.

Executive Director Compensation The Compensation Committee approved a compensation package for Mr. Duncan as CEO for the 2023 Fiscal Year (as defined below). Mr. Duncan is an employee of the Company and does not receive any additional compensation for serving as a director.

OUR EXECUTIVE OFFICERS Set forth below is biographical information about each of

our executive officers.

Our Executive Officers

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Executive VP, General Counsel and Secretary Age: 54 Officer since: 2018 | William S. Moss III Mr. Moss has served as our Executive Vice President, General Counsel and Secretary since May 2018. Mr. Moss previously served as Senior Vice President and General Counsel of Talos Energy LLC from May 2013 to May 2018. Prior to Talos Energy LLC, Mr. Moss was a partner at Mayer Brown LLP in Houston where he was the head of the Houston Corporate Practice. Mr. Moss joined Mayer Brown LLP in May 2005. At Mayer Brown LLP, Mr. Moss’s practice focused on mergers and acquisitions, securities offerings and general corporate and securities matters and he represented clients throughout the energy value chain. Mr. Moss joined Talos Energy LLC after having represented Talos Energy LLC as outside counsel in its initial formation and its subsequent acquisition of |

Executive Vice President and Head of Operations Age: 53 Officer since: 2023 | John B. Spath Mr. Spath has served as the Executive Vice President and Head of Operations of the Company since December 2023. Prior to that, Mr. Spath served as Senior Vice President of Operations, overseeing Production Operations, Drilling and Completions, Facilities and Major Projects, ARO Operations and Supply Chain. Mr. Spath was promoted in May 2018 to Senior Vice President of Drilling and Production Operations, where he was responsible for several operational functions during varying times, including Production Operations, Production Engineering, Drilling and Completions, ARO Operations, Regulatory Compliance and Supply Chain. In November 2015, Mr. Spath was appointed to Vice President of Production Operations, overseeing multiple operational activities, including Production Operations, Production Engineering, ARO Operations, and Facilities Engineering. Mr. Spath joined the Company as a Drilling Manager in 2013. Mr. Spath has over 28 years of experience in the energy industry. Mr. Spath began his career at J. Ray McDermott as a Process Engineer in 1995, followed by over eight years at Marathon Oil Corporation, leading offshore projects as a Facilities Engineer, Production Foreman and Deepwater Drilling Engineer. Mr. Spath continued to hold various offshore drilling roles, as an international and Independent Deepwater Consultant on deepwater Drilling and Completion projects for Mariner Energy, Inc., Stone Energy Corporation, Deep Gulf Energy LP and Helix Energy Solutions Group. Mr. Spath graduated from the University of Louisiana at Lafayette in 1995 with a Bachelor of Science in Mechanical Engineering and is a licensed professional engineer in the state of Texas. Mr. Spath is a member of the Energy Education Council’s Board of Directors. Mr. Spath is also the Chairman of the Ronald McDonald House charity golf tournament. |

2019 Proxy Statement 13

2024 PROXY STATEMENT | 31 |

MEETINGS AND COMMITTEES OF DIRECTORS

The Board of Directors held nine meetings during 2018. During 2018, each of our incumbent directors attended at least 75% of the meetings of the Board of Directors and the meetings of the committees of the Board of Directors on which that director served (in each case, which were held during the period for which such incumbent director was a director and a member of the respective committees).

Our Executive Sessions. The Board of Directors holds regular executive sessions in which the independent directors meet without anynon-independent directors or members of management. The purpose of these executive sessions is to promote open and candid discussion among the independent directors. The lead director, Mr. Goldman, presides at these meetings and provides the Board of Directors’ guidance and feedback to our management team.

The Board of Directors has four standing committees: the Audit Committee, the Compensation Committee, the Governance & Nominating Committee and the Safety Committee.

Audit Committee. The primary responsibilities of the Audit Committee are to oversee our accounting and financial reporting processes as well as our affiliated and subsidiary companies, and to oversee the internal and external audit processes. The Audit Committee also assists our board of directors in fulfilling its oversight responsibilities by reviewing the financial information which is provided to stockholders and others and the system of internal controls which management and the Board have established. The Audit Committee oversees the independent auditors, including their independence and objectivity. However, the Audit Committee members do not act as professional accountants or auditors, and their functions are not intended to duplicate or substitute for the activities of management and the independent auditors. The Audit Committee is empowered to retain independent legal counsel and other advisors as it deems necessary or appropriate to assist the Audit Committee in fulfilling its responsibilities, and to approve the fees and other retention terms of the advisors. The Audit Committee is also tasked with periodically reviewing all related party transactions in accordance with our applicable policies and procedures and making a recommendation to the Board regarding the initial authorization or ratification of any such transaction.

The responsibilities of the Audit Committee are further detailed in the “Audit Committee Charter” that is posted on our website, www.talosenergy.com, and the “Audit Committee Report” included in this Proxy Statement.

Pursuant to the Stockholders’ Agreement, the Audit Committee must consist solely of “Company Independent Directors” until Section 3.1 of the Stockholders’ Agreement expires. For additional information regarding the terms of the Stockholders’ Agreement, see “Proposal One: Election of Directors—Stockholders’ Agreement” and “Certain Relationships and Related Party Transactions—Transactions Entered Into Prior to or in Connection with the Stone Combination—Stockholders’ Agreement.”

The members of the Audit Committee are Messrs. Sledge (Chair), Kendall and Juneau. The Audit Committee held eight meetings during 2018.

Compensation Committee. Responsibilities of the Compensation Committee, which are discussed in detail in the “Compensation Committee Charter” that is posted on the Company’s website at www.talosenergy.com, include, among other duties, the responsibility to:Officers

periodically review and approve the compensation and other benefits for our employees, officers and independent directors;

review and approve corporate goals and objectives relevant to the compensation of our executive officers in light of those goals and objectives, and setting compensation for these officers based on those evaluations;

2019 Proxy Statement 14

Senior Vice President and Chief Financial Officer Age: 43 Officer since: 2023 | Sergio L. Maiworm, Jr. Mr. Maiworm has served as the Senior Vice President and Chief Financial Officer of the Company since June 2023 and previously served as the Vice President of Finance, Investor Relations and Treasurer of the Company since May 2019. Mr. Maiworm joined the Company in April 2018 as Director of Finance and Investor Relations. Prior to joining the Company, Mr. Maiworm was an energy investment banker with Deutsche Bank from September 2015 to April 2018, where he advised clients in the E&P sector on public and private capital raisings and strategic transactions. Before Deutsche Bank, Mr. Maiworm was a Manager in the global Mergers & Acquisitions group of Royal Dutch Shell plc based in Houston from October 2013 to September 2015. Previously, Mr. Maiworm served as a Director of Finance at ION Geophysical Corporation and spent over eight years at Transocean Ltd., where he held positions of increasing responsibility in accounting and finance in Houston, Brazil and Switzerland. Mr. Maiworm started his career in the Audit practice of Deloitte & Touche in 2004. Mr. Maiworm earned a B.S. in Business Administration from the Pontificia Universidade Catolica do Rio de Janeiro (PUC-Rio) and an M.B.A. from the McCombs School of Business at the University of Texas at Austin. Mr. Maiworm is also a graduate of Harvard Business School’s General Management Program. |

Vice President and Chief Accounting Officer Age: 40 Officer since: 2019 | Gregory M. Babcock Mr. Babcock has served as our Vice President and Chief Accounting Officer (Principal Accounting Officer) since August 2019. Previously, Mr. Babcock served as the Company’s Corporate Controller from May 2018 to August 2019. Prior to that, Mr. Babcock served as the Assistant Controller of Talos Energy LLC from September 2015 until the May 2018 business combination of Talos Energy LLC and Stone Energy Corporation pursuant to which Talos Energy LLC became a wholly owned subsidiary of the Company. Before his promotion to Assistant Controller, Mr. Babcock served as Financial Reporting Manager of Talos Energy LLC from May 2014 to September 2015. Prior to his tenure with Talos Energy LLC, Mr. Babcock worked for Deloitte & Touche, holding positions of increasing responsibility in audit and mergers and acquisitions transaction services. Mr. Babcock began his career with Deloitte & Touche in 2007. Mr. Babcock is a Certified Public Accountant and holds a MS in Finance and BBA in Accounting from Texas A&M University. |

| 32 |

|

administer the issuance of stock awards under any stock compensation plans;EXECUTIVE COMPENSATION MATTERS

reviewCompensation Discussion and discuss with the Company’s management theAnalysis

Executive Summary

This Compensation Discussion and Analysis included in this Proxy Statement;

produce(“CD&A”) describes our compensation practices and the Compensation Committee Report as requiredcompensation awarded to, earned by, Item 407(e)(5)or paid to each of RegulationS-K included in this Proxy Statement;

otherwise discharge the Board’s responsibilities relating to compensation of the Company’sour named executive officers and directors; and

perform such other functions as the Board may assign to the Compensation Committee from time to time.

The Compensation Committee is delegated all authority of the Board of Directors as may be requiredlisted below (the “Named Executive Officers” or advisable to fulfill its purposes. The Compensation Committee may delegate to its Chairman, any one of its members or any subcommittee it may form, the responsibility and authority for any particular matter, as it deems appropriate from time to time under the circumstances. The Compensation Committee is also generally able to delegate authority to review and approve the compensation of our employees to certain executive officers, including with respect to stock option or stock appreciation rights grants made under any stock option plans, stock compensation plans or stock appreciation rights plans. Pursuant to the Stockholders’ Agreement and subject to certain limitations and qualifications, the Compensation Committee, among other things, determines compensation for our Chief Executive Officer and all executive officers who report directly to the Chief Executive Officer.

Meetings of the Compensation Committee may, at the discretion of the Compensation Committee, include members of the Company’s management, other members of the Board of Directors, consultants or advisors and such other persons as the Compensation Committee believes to be necessary or appropriate.

The Compensation Committee may, in its sole discretion, retain and determine funding for legal counsel, compensation consultants, as well as other experts and advisors (collectively, “Committee Advisors”“NEOs”), including the authority to retain, approve the fees payable to, amend the engagement with and terminate any Committee Advisor, as it deems necessary or appropriate to fulfill its responsibilities. The Compensation Committee assesses the independence of any Committee Advisor prior to retaining such Committee Advisor.

The members of the Compensation Committee are Messrs. Trimble (Chair) and Mahagaokar and Ms. Wassenaar. The Compensation Committee held three meetings during 2018.

Governance & Nominating Committee. The Governance & Nominating Committee, subject to the terms of the Stockholders’ Agreement, assists the Board with respect to (i) the organization and membership and function of the Board, including the identification and recommendation of director nominees and the structure and membership of each committee of the Board, (ii) corporate governance principles applicable to us and (iii) our policies and programs that relate to matters of corporate responsibility. The Governance & Nominating Committee, subject to the terms of the Stockholders’ Agreement, reviews and makes recommendations to the Board regarding the composition of the Board of Directors structure, format and frequency of the meetings. The Governance & Nominating Committee also reviews and makes recommendations to the Board regarding the nature, composition and duties of the committees of the Board and will review and consider any stockholder-recommended candidates for nomination to the Board.

Additional information regarding the functions performed by the Governance & Nominating Committee is set forth in the “Corporate Governance” and “Stockholder Proposals; Identification of Director Candidates” sections included herein and also in the “Governance & Nominating Committee Charter” that is posted on the Company’s website at www.talosenergy.com.

2019 Proxy Statement 15

Pursuant to the Stockholders’ Agreement, the Governance & Nominating Committee is required to be composed of three directors, including at least two “Company Independent Directors,” until Section 3.1 of the Stockholders’ Agreement expires. For additional information regarding the terms of the Stockholders’ Agreement, see “Proposal One: Election of Directors—Stockholders’ Agreement” and “Certain Relationships and Related Party Transactions—Transactions Entered Into Prior to or in Connection with the Stone Combination—Stockholders’ Agreement.”

The members of the Governance & Nominating Committee are Messrs. Goldman (Chair), Tichio and Sledge. The Governance & Nominating Committee held three meetings during 2018.

Safety Committee. The Safety Committee reviews our safety programs and policies and recommends any proposed changes to the Board, monitors our compliance with our safety programs and policies and reviews our safety statistics and reviews significant public policy and legislative and regulatory issues or trends related to safety matters and provides us input with respect to such policies, issues and trends. The Safety Committee is also expected to meet with our management to review the implementation and effectiveness of our safety programs and policies. Additionally, the Safety Committee is tasked with the oversight and management of our environmental, social and governance initiatives.

The members of the Safety Committee are Ms. Hommes (Chair) and Messrs. Juneau and Trimble. The Safety Committee held three meetings during 2018.

2019 Proxy Statement 16

The information contained in this Compensation Committee Report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), except to the extent that the Company specifically incorporates such information by reference in such filing.

The Compensation Committee reviewed and discussed the Compensation Discussion and Analysis required by Item 402 of RegulationS-K promulgated by the SEC with management of the Company and, based on such review and discussions, the Compensation Committee recommended to the Board that such Compensation Discussion and Analysis be included in this Proxy Statement and incorporated by reference into the Company’s Annual Report on Form10-K for the fiscal year ended December 31, 2018.

2019 Proxy Statement 17

Compensation Discussion and Analysis

Overview

This Compensation Discussion and Analysis identifies the elements of compensation and explains the compensation objectives and practices for the individuals identified in the following table, who are referred to herein as our “Named Executive Officers,” for the fiscal year ended December 31, 20182023 (the “2018“2023 Fiscal Year”).

Named Executive Officers for 2023

For the 2023 Fiscal Year, our Named Executive Officers consisted of the following:

Name |

| |||

Timothy S. Duncan | President and Chief Executive Officer | |||

| Senior Vice President and Chief Financial Officer | |||

John A. Parker | Executive Vice President of New Ventures | |||

William S. Moss III | Executive Vice President and General Counsel | |||

Robin Fielder (2) | Former Executive Vice President – Low Carbon Strategy and Chief Sustainability Officer | |||

Shannon E. Young III (1) | Former Executive Vice President and Chief Financial Officer | |||

Robert D. Abendschein (3) | Former Executive Vice President and Chief Operating Officer | |||

| (1) | On June 13, 2023, Shannon E. Young III notified the Company that he was resigning from his position of Executive Vice President and Chief Financial Officer, |

| (2) |

|

| (3) | On December 1, 2023, the Company terminated Robert D. Abendschein from his position of Executive Vice President and Chief Operating Officer, | |||

effective as of the same day. Effective December 1, 2023, John | ||||

| B. Spath was appointed as the Company’s Executive Vice President and |

Successful Leadership Transitions

In connection with changes to our executive leadership team, our Chief Executive Officer and Board of Directors efficiently transitioned Mr. Maiworm into the role of Chief Financial Officer, and Mr. Spath into the role of Executive Vice President and Head of Operations. Because such promotions occurred from within the management team, each of Mr. Maiworm and Mr. Spath were well positioned for the new executive leadership roles with a deep understanding of our business, culture, projects, employees and executives, thus ensuring smooth and uneventful transitions.

Mr. Maiworm brings over 20 years of energy and finance experience to the role of Chief Financial Officer. He has significant knowledge and expertise in finance, treasury, investor relations and accounting and a deep understanding of our business, all of which positioned him well to take on the role of Chief Financial Officer. Mr. Maiworm previously served as Vice President of Finance, Investor Relations and Treasurer of the Company since May 2019. Mr. Maiworm joined the Company in April 2018 as Director of Finance and Investor Relations.

Mr. Spath has over 28 years of energy industry experience spanning roles in engineering, offshore operations, deepwater drilling, and senior management. He has been with the Company for over ten years, most recently serving as Senior Vice President of Operations. Mr. Spath has also held positions as Senior Vice President of Drilling and Production Operations, Vice President of Production Operations, and Drilling Manager since joining the Company in 2013.

On March 27, 2024 Robin Fielder’s employment with the Company and its affiliates terminated by her for good reason because her role was eliminated in connection with the sale of the Company’s CCS business.

| 33 |

Executive Compensation Matters

Compensation Objectives and Practices

Our executive compensation program is designed to attract, retain and motivate talented executives who possess the knowledge and expertise to create long-term value for our stockholders. We structure our executive compensation program with a view towards promoting accountability to ensure thataligning the interests of management with those of our management and stockholders remain aligned.stockholders. We believe that these goals are accomplished by tying components of our executive compensation program to measures of the Company’s short-term and long-term performance.

The chart below highlights several features of our executive compensation program.

What We Do | What We Don’t Do | |||

✓ Pay for performance, including for sustained performance over multi-year performance periods ✓ Make a significant portion of compensation performance-based and at-risk (87% for CEO) ✓ Compensation Committee retains independent compensation consultant and counsel ✓ Utilize an appropriate peer group in determining compensation elements and levels of pay ✓ Maintain stock ownership requirements for executives and directors ✓ Maintain a strong clawback policy ✓ Perform annual risk assessment of executive compensation program | × No excessive perquisites × No taxgross-ups | |||

| × No current dividend payments on unvested equity awards | |||

| × × No hedging or pledging of Company securities × No individualized employment or severance agreements for our executive officers | |||

Performance-Based Compensation Structure

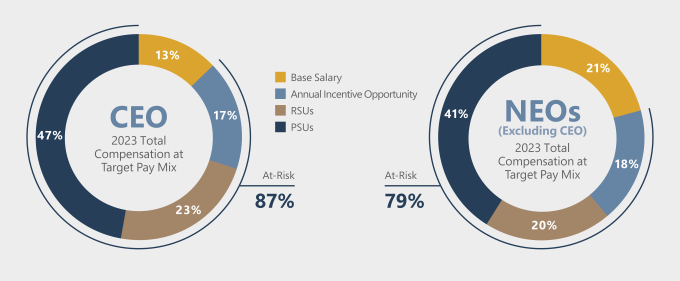

The Company believes that making a substantial portion of our Named Executive Officers’ target compensation “at risk,” and a substantial portion of such at risk compensation performance-based, ensures that their interests strongly align with those of our stockholders.

*Figures calculated utilizing base salary and target values for annual cash bonus and long-term incentive awards approved by the Board for 2023 and are not based on the figures reported in the Summary Compensation Table, which report actual annual cash bonus amounts paid for 2023 and the grant date fair value of the long-term incentive awards granted in 2023 calculated and in accordance with FASB ASC Topic 718 and which would result in a higher percentage of at risk compensation. At risk compensation includes annual bonus and long-term incentive awards.

| |||||

|

Executive Compensation Matters

Stockholder Outreach in 2023

Company officers meet routinely with stockholders and investors throughout the year to discuss issues and perspectives relating to the Company. We believe that these engagements help ensure that the Board and our management team hear from interested stockholders and can consider their views as appropriate. Our management team initiated stockholder outreach in 2023, targeting stockholders representing over 70% of our shares, with the goal of getting feedback on topics of interest to our stockholders such as executive compensation, corporate governance and environmental, social and governance matters. In addition to considering feedback from shareholder engagements, the Board and Compensation Committee also carefully consider the results from annual shareholder advisory votes on executive compensation, as well as other shareholder input, when reviewing executive compensation programs, principles and policies. These engagements with our stockholders occurred both before and following our 2023 Annual Meeting of Stockholders, though most occurred in the fall of 2023 following the meeting. Our Board, Compensation Committee and management team take our stockholders’ concerns seriously and are committed to listening and incorporating changes to our compensation program when warranted.

Say-on-Pay Vote

In 2023, 85% of the stockholders who cast a vote voted to approve, on an advisory basis, the compensation of our Named Executive Officers for that year (commonly referred to as a “Say-on-Pay” vote). The Compensation Committee understands, as a result of shareholder feedback, that the somewhat lower level of support in 2022 and 2023 as compared to prior years, was primarily the result of the cancellation of the Company’s performance share units (“PSUs”) and grant of retention RSUs in their place in 2022. The Board and the Compensation Committee value performance-based compensation and only took such action after great deliberation. The Board determined that the cancellation and regrant was necessary to retain and motivate the valued executive team and that the low performance with respect to the canceled PSUs was largely the result of factors outside the control of our executive team. The Compensation Committee and the Board do not anticipate taking any similar action in the future. For additional information regarding these matters please see the proxy statement filed by the Company in 2023.

Through stockholder outreach, we asked for and received meaningful stockholder feedback on specific elements of our executive compensation program in 2022. The stockholders we spoke with during 2023 did not identify concerns regarding our executive compensation program. As a result, our Compensation Committee did not elect to make any material changes to our executive compensation program in 2023.

We seek a non-binding advisory vote on the compensation of Named Executive Officers annually. The Board unanimously recommends that stockholders vote for the approval, on a non-binding advisory basis, of the Named Executive Officer compensation for the fiscal year ended December 31, 2023 as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the SEC. The next non-binding advisory vote on the frequency of non-binding advisory votes on our Named Executive Officer compensation will be held in 2025.

Process for Setting Executive Compensation

Our Board determines and approves our executive compensation program is ultimately determined bybased on many factors, including the Board, following recommendations fromof the Compensation Committee and input from ourthe Compensation Committee’s independent compensation consultant and the executive officers.

Role of the Compensation Committee

Although the ultimate responsibility for executive compensation decisions lies with the Board, ourthe Compensation Committee oversees the executive compensation program, is generally overseenand the Board’s decisions are typically determined based on the recommendation by the Compensation Committee after thorough review and consideration.

The Board, upon the Board’s decisions are

2019 Proxy Statement 18

typically made following a recommendation byevaluation of the Compensation Committee. The CompensationNominating & Governance Committee, is comprised of James M. Trimble (who acts as the chair), Rajen Mahagaokar and Olivia C. Wassenaar. Eachhas determined that each member of the Compensation Committee meets the independence standards established by the New York Stock Exchange (“NYSE”).NYSE. The Compensation Committee Charter generally provides the Compensation Committee with authority to (i) exercise oversight of our executive compensation policy, (ii) review, approve and recommend to the Board compensatory payments to our officers, (iii) review and modify decisions on individualnon-officer employee compensation, (iv) review, modify and approve our peer companies, and (v) review and recommend to the Board the compensation for ournon-employee directors. to:

| • | exercise oversight of our executive compensation policy; |

| • | review, approve and recommend to the Board compensatory payments to our senior vice presidents and above, including the Chief Executive Officer; |

| • | review and modify decisions on individual non-officer employee compensation; |

| • | review, modify and approve our peer companies; |

2024 PROXY STATEMENT | 35 |

Executive Compensation Matters

| • | review and recommend to the Board the compensation for our non-employee directors; |

| • | review and approve agreements with our officers affecting any elements of compensation and benefits; and |

| • | administer the Company’s Clawback Policy. |

For more detailed information regarding the Compensation Committee, the current Compensation Committee Charter is posted under the “Corporate Governance & Board Committees” subsection ofGovernance” tab within the “About Us”“Investor Relations” section of our website atwww.talosenergy.com.

Role of the Executive Officers

Our Chief Executive Officer reviews compensation for Named Executive Officers and any other Senior Vice Presidents and above, and makes compensation recommendations (other than for his own compensation) for such officers to the Compensation Committee and the Board. The Board makes the final determinations with respect to each Named Executive Officer’s compensation, except for the compensation of our Chief Executive Officer, which is approved by independent members of the Board. Our Chief Executive Officer, General Counsel, and head of Human Resources provide relevant information, input and guidance to the Compensation Committee and the Board, as appropriate and/or requested, to assist the Compensation Committee in making its recommendations to the Board. Members of our management team do not attend executive sessions of the Compensation Committee or the Board .

Role of the Compensation Consultant

Following the Stone Combination,During 2023, the Compensation Committee engaged Lyons, Benenson & Company Inc. (“LB&Co”)Meridian as its independent compensation consultant. LB&CoMeridian provided advice, relevant market and peer group data, current trends and practices and other input related to executive and worked alongsidedirector compensation to the Compensation Committee and the Board in structuring our executive2023 compensation program. LB&Co provided the Compensation Committee with relevant market and peer group compensation data and information on current trends and developments regarding executive and director compensation. The information provided by LB&CoMeridian was utilized by the BoardCompensation Committee and the Compensation CommitteeBoard in making decisions regarding executive and director compensation.

LB&CoMeridian reported directly and exclusively to the Compensation Committee and did not provide any other services to us,the company, management or our affiliates. LB&CoMeridian did not make compensation-related decisions for the Compensation Committee, the Board or otherwise with respect to the company. Although the Compensation Committee and the Board generally reviewed and considered information and recommendations provided by Meridian, the Compensation Committee and the Board have the sole responsibility and authority to make all compensation-related decisions.

Role of the Compensation Legal Counsel

Cooley LLP (“Cooley”) was engaged directly by the Compensation Committee during 2023 as its independent legal compensation counsel. Cooley provided advice to and worked alongside the Compensation Committee, Meridian and the Board in structuring and reviewing our 2023 executive compensation program.

Cooley reported directly and exclusively to the Compensation Committee as legal counsel and did not provide any other services to the company, management or our affiliates. Cooley did not make compensation-related decisions for the Compensation Committee, for the Board or otherwise with respect to us,the company.

Conflicts of Interest and whileIndependence of the Compensation CommitteeConsultant and the Board generally reviewed and considered information and recommendations provided by LB&Co, the Compensation Committee and the Board always retain the authority to make all compensation-related decisions. Legal Counsel

The Compensation Committee has the discretion to allow compensation consultants including LB&Co in 2018,and counsel to work directly with management in preparing or reviewing materials for the Compensation Committee’s consideration. During 2018,2023, and after taking into consideration the factors listed in Section 303A.05(c)(iv) of the NYSE Listed Company Manual, the Compensation Committee concluded that neither it nor the Company has any conflicts of interest with LB&CoCooley or Meridian and that LB&Co isCooley and Meridian each are independent from management.

AtPeer Group

The companies that comprise the end of 2018,peer group reflect companies in the oil and gas exploration and production industry against which we compete for business opportunities, investor capital and/or executive talent. In selecting the Company’s peer group, the Compensation Committee engaged Meridian Compensation Partners, LLC (“Meridian”) as its new independent compensation consultant. Meridian did not providereviews the peer group to determine if the number of companies is appropriate and provides statistical validity. Each year, the Compensation Committee with advice used for making determinations regarding 2018 Fiscal Yearrevisits the qualifications of the current peer group, including scope of operations; geographic location; financial and operational metrics (including value of assets, enterprise value, market capitalization, and revenue); and the availability of market compensation rather it focused on providing information that will be used to make compensation decisions in 2019. Other than LB&Co and Meridian, no other compensation consultants provided services todata of the proposed peer group. The Compensation Committee during 2018.may consider modifications from time to time resulting from changes in business strategy, mergers and acquisitions, bankruptcies or other factors that may cause peer companies to no longer exist or to no longer be comparable to our business.

Role of

| 36 |

|

Executive Compensation Matters

Based on the Executive Officers

Our Chief Executive Officer reviews compensation for all of our Named Executive Officers other than himself and makes compensation recommendations to the Compensation Committee and the Board; however the Board makes the final determinations with respect to each Named Executive Officer’s compensation. Other members of management, particularly from our human resources and legal departments, provide relevant data and guidance to the Compensation Committee and board of directors, as requested, to assist themforegoing criteria, in making compensation determinations and implementing those decisions. Our Chief Executive Officer and General Counsel attend select meetings of2023, the Compensation Committee and the Board, to provide relevant information and input, as appropriate. During executive sessions of the Compensation Committee or the Board, our Chief Executive Officer and General Counsel are excused.

2019 Proxy Statement 19

Peer Group

In 2018, the Compensation Committee, with input from LB&Co, selected our peer group after reviewing market capitalization and total enterprise value of relevant public companies to determine which companies were representative of the marketplace for talent within which we compete. The Compensation CommitteeMeridian, determined that the companies listed in the table below reflect an appropriate peer group for 2018to inform decisions regarding 2023 compensation levels (the “Peer“2023 Peer Group”), which is the same peer group utilized in determining relative total stockholder return for purposes of the performance share unit awards granted to the Named Executive Officers, as described below under “Elements of Compensation for the 2018 Fiscal Year—Long Term Incentive Awards”:

| 2023 Peer Group | |||||

|

| ||||

Callon Petroleum Company (NYSE: CPE) |

| ||||

|

| ||||

Civitas Resources, Inc. (NYSE: CIVI)(1) |

| ||||

|

| ||||

Denbury Inc.(3) |

| ||||

Kosmos Energy |

| ||||

Magnolia Oil & Gas Corporation (NYSE: MGY) | W&T Offshore, Inc. (NYSE: WTI) | ||||

| (1) |

|

|

| |||

and Extraction Oil & Gas, Inc. in 2022. |

| (2) | Chord Energy Corp. is the result of a merger between Oasis Petroleum Inc. and Whiting Petroleum Corporation in 2022. |

| (3) | These companieswere included in the 2023 Peer Group and were acquired during the 2023 year: Ranger Oil Corporation was acquired by Baytex Energy Corp.; PDC Energy, Inc. was acquired by Chevron Corporation; and Denbury Inc. was acquired by Exxon Mobil Corporation. |

| (4) | In September 2022, Centennial Resource Development, Inc. changed its name to Permian Resources Corporation. |

| (5) | In January 2023, Laredo Petroleum, Inc. changed its name to Vital Energy, Inc. |

The 2023 Peer Group was modified from the 2022 peer group as noted below. Companies were added based on the factors noted above and were generally removed as a result of an acquisition or bankruptcy.

| Removed | Added | |||

Bonanza Creek Energy, Inc.(1) | Berry Corporation | |||

(1) | Chord Energy Corporation | |||

Oasis Petroleum Inc.(2) | Civitas Resources, Inc. | |||

QEP Resources, Inc.(3) Whiting Petroleum Corporation(2) | Denbury Inc. California Resources Corporation Ranger Oil Corporation | |||

| (1) | Bonanza Creek Energy, Inc. and Extraction Oil & Gas, Inc. merged and were replaced in the 2023 Peer Group with the new combined company, Civitas Resources, Inc. |

| (2) | Oasis Petroleum Inc. and Whiting Petroleum Corporation merged and were replaced in the 2023 Peer Group with the new combined company, Chord Energy Corporation. |

| (3) | QEP Resources, Inc. merged with Diamondback Energy Inc. in 2021 and the Compensation Committee felt that the combined company was not an appropriate peer after reviewing the factors above. |

Use of 2023 Peer Group

The Compensation Committee evaluated compensation analysis of the 2023 Peer Group prepared by Meridian in making its compensation recommendations. The analysis included market data for each element of compensation and information regarding the Board reviewedincentive plan designs and pay practices among the 2023 Peer Group including NEO compensation levels of executive officers ofat the companies in the 2023 Peer Group, based on Meridian’s proprietary oil and gas exploration and production industry survey database, supplemented by information in peer company public disclosures. The Compensation Committee used the compensation analysis as a reference point for assessing the overall competitiveness of our Peer Group. When settingexecutive compensation program. The Compensation Committee does not target a specific market percentile, but rather takes into account the scope of the job, complexity of the position and performance of the executive, in context of peer data and trends. The Compensation Committee also considered compensation paid by certain other reference companies, which for our Named 2023 included Green Plains Inc., FuelCell Energy, Inc., and Clean Energy Fuels Corp. These companies are not part of the formal competitive compensation analysis but are intended to provide a market reference for renewable energy compensation practices outside the oil and gas exploration and production industry.

2024 PROXY STATEMENT | 37 |

Executive Officers, theCompensation Matters

Setting Target Compensation

The Compensation Committee and the Board did not benchmarktarget any element of compensation, or overall compensation, to a particular benchmark level of pay as compared to the compensation paid to similarly situated officers(e.g., median) of the companies2023 Peer Group in our Peer Group.determining target compensation levels for the Named Executive Officers. Rather, as the Compensation Committee has historically done, it used 2023 Peer Group data isas one of manyseveral factors taken into account by the Compensation Committeeit considered in evaluating and the Board when setting and evaluating each element of our executive compensation programprogram. This helps to ensure that our compensation program is competitive within our peer group in line with market practices and that we are ableorder to attract and retain executive officers with the requisite talent and experience to help us achievefor our short- and long-term goals. The Compensation Committee and the Board will periodically review and adjust the Peer Group to ensure that the companies within the Peer Group are appropriate for use in making compensation decisions.business.

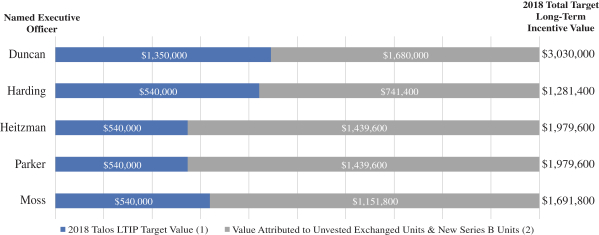

Elements of Compensation for the 20182023 Fiscal Year

In order toTo maintain an appropriate balance between fixed and variable compensation and to ensure that portionstie a significant portion of each Named Executive Officer’s compensation are tied to the achievement of short-term and long-term goals, the Board, following the recommendation of the Compensation Committee, determined that the following compensatory elements were appropriate for our Named Executive Officers infor the 20182023 Fiscal Year:

Base salary;

Short-term cash incentive awards;

Transaction bonuses;

Long-term equity awards in the form of restricted stock units and performance share units;

Health and welfare and retirement benefits; and

Limited perquisites.

In addition to The balance among the elements of total direct compensation listed aboveis established annually by the Compensation Committee and is designed to recognize past performance, retain key employees and encourage future performance. When conducting its annual deliberations, the Compensation Committee reviews each component against both historical and recent comparative statistics as well as anticipated trends in compensation with comparisons to the reference peer group. The Compensation Committee also considers the compensation arrangements of other employees within the Company when determining executive compensation. The Compensation Committee believes that were determined by us, Series B Units in certainthe design of our stockholders were also grantedcompensation program is appropriate and competitive.

| Key compensation elements | Primary metrics | Purpose and Key terms | ||||

Base Salary

| N/A | • Based on competitive considerations, responsibilities, expertise, experience and tenure • Fixed base of cash compensation to attract and retain talent | ||||

| Target Annual Incentive

| • Free Cash Flow Generation (25%) • Upstream Adjusted EBITDA (15%) • Health and Safety Measures (10%) • CCS Project Execution (20%) • GHG Emissions and Methane Reduction (10%) • Strategic Initiatives (20%) | • To drive achievement of key business results on an annual basis • To recognize individuals based on their contributions to the Company’s success • Performance-based and not guaranteed • Emphasizes focus on safety and ESG, important factors in our culture and long-term growth • Payouts can range from 0% to 200% of the target award | |||

| Long-Term Incentive Awards | ||||||

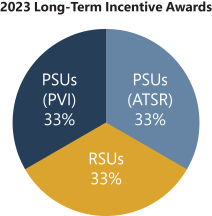

Performance share units | • Absolute TSR (50%) • Capital project returns (PVI) (50%) | • To directly tie interests of executives to interests of stockholders • To retain and motivate key talent • Performance-based and not guaranteed • Provides the right to receive a share of Talos’s stock at the end of a three-year performance period, subject to the Company’s achievement of pre-established Absolute TSR and capital project returns goals • Payouts are limited to 200% of the target award | ||||

Restricted stock units | • Stock price | • RSUs granted in 2023 vest annually over three years | ||||

| 38 |

|

Executive Compensation Matters

Base Salary

Base salaries for our NEOs are reviewed annually by the Compensation Committee. Named Executive Officers in 2018.

Base Salary

TheOfficer base salaries provided to our Named Executive Officers are a fixed portion of theirthe total compensation that reflectsset at levels commensurate with their responsibilities, expertise, experience, market rate and tenure. After reviewing the base salaries of executive

2019 Proxy Statement 20

officers in the 2023 Peer Group and upon recommendation by the Compensation Committee, on March 5, 2023, the Board approved adjustments to the annualizedan increase in base salary on August 29, 2018, retroactive to the closing of the Stone Combination on May 10, 2018,salaries for each Named Executive Officer to reflect the increased responsibilities ofalign their positions following the Stone Combination and to begin to bring theiroverall compensation in line with the compensation paid to similarly situated executives of the companies in our Peer Group.market practices. The table below reflects these increases.the base salaries for the Named Executive Officers in 2022 and 2023.

Name | Base Salary prior to Stone Combination | Base Salary following Stone Combination | Percent of Increase | |||||||||||||||||||||

Name | ||||||||||||||||||||||||

Name | ||||||||||||||||||||||||

Name | 2022 Base Salary | 2023 Base Salary | Percentage Change from 2022 to 2023 | |||||||||||||||||||||

Timothy S. Duncan | $ 440,000 | $ 650,000 | 47.7 | % | ||||||||||||||||||||

Michael L. Harding II | $ 322,500 | $ 380,000 | 17.8 | % | ||||||||||||||||||||

Stephen E. Heitzman | $ 375,950 | $ 400,000 | 6.4 | % | ||||||||||||||||||||

Timothy S. Duncan | ||||||||||||||||||||||||

Timothy S. Duncan | ||||||||||||||||||||||||

Timothy S. Duncan | $ | 825,000 | $ | 865,000 | 4.8 | % | ||||||||||||||||||

Sergio L. Maiworm, Jr. (1) | ||||||||||||||||||||||||

Sergio L. Maiworm, Jr. (1) | ||||||||||||||||||||||||

Sergio L. Maiworm, Jr. (1) | ||||||||||||||||||||||||

Sergio L. Maiworm, Jr. (1) | $ | 325,000 | $ | 425,000 | 20.8 | % | ||||||||||||||||||

John A. Parker | $ 375,950 | $ 400,000 | 6.4 | % | ||||||||||||||||||||

John A. Parker | ||||||||||||||||||||||||

John A. Parker | ||||||||||||||||||||||||

John A. Parker | $ | 455,000 | $ | 480,000 | 5.5 | % | ||||||||||||||||||

William S. Moss III | $ 375,950 | $ 380,000 | 1.1 | % | ||||||||||||||||||||

William S. Moss III | ||||||||||||||||||||||||

William S. Moss III | ||||||||||||||||||||||||

William S. Moss III | $ | 435,000 | $ | 455,000 | 4.6 | % | ||||||||||||||||||

Robin Fielder | ||||||||||||||||||||||||

Robin Fielder | ||||||||||||||||||||||||

Robin Fielder | ||||||||||||||||||||||||

Robin Fielder | $ | 435,000 | $ | 455,000 | 4.8 | % | ||||||||||||||||||

Shannon E. Young III (2) | ||||||||||||||||||||||||

Shannon E. Young III (2) | ||||||||||||||||||||||||

Shannon E. Young III (2) | ||||||||||||||||||||||||

Shannon E. Young III (2) | $ | 525,000 | $ | 550,000 | 4.8 | % | ||||||||||||||||||

Robert D. Abendschein (3) | ||||||||||||||||||||||||

Robert D. Abendschein (3) | ||||||||||||||||||||||||

Robert D. Abendschein (3) | ||||||||||||||||||||||||

Robert D. Abendschein (3) | $ | 525,000 | $ | 550,000 | 4.8 | % | ||||||||||||||||||

| (1) | Effective July 1, 2023, Sergio L. Maiworm, Jr. was appointed as the Company’s Senior Vice President and Chief Financial Officer. Preceding his appointment as Chief Financial Officer, Mr. Maiworm served as Vice President of Finance, Investor Relations and Treasurer of the Company. Mr. Maiworm’s base salary was set at $360,000 on March 5, 2023, prior to his promotion as Chief Financial Officer. His base salary was increased to $425,000 in connection with his promotion. |

2019 Proxy Statement 21

| (2) | Effective June 30, 2023, Shannon E. Young III resigned as Executive Vice President and Chief Financial Officer. The amount above is the annual base salary approved by the Board on March 5, 2023, not the actual amount of base salary paid to him for 2023, which is reflected in the Summary Compensation Table below. |

| (3) | On December 1, 2023, the Company terminated Robert D. Abendschein as Executive Vice President and Chief Operating Officer, effective as of the same day. The amount above reflects the annual base salary approved by the Board on March 5, 2023, not the actual amount of base salary paid to him for 2023, which is reflected in the Summary Compensation Table, below. |

Annual Incentive Program

Short-Term CashWe have established an Annual Incentive Awards

For the 2018 Fiscal Year, we awarded short-term cash incentive awards based on our achievement of the following performance measures: (i) financial performance measures, including free cash flow generation, general and administrativeProgram (“G&A”AIP”) expenses, and earnings before interest, taxes, depreciation and amortization (“EBITDA”); (ii) operational performance measures, including total production measured in thousands of barrels of oil equivalent per day (“mboe/d”) and total direct lease operating expense (“LOE”); (iii) asset management measure of proved developed finding and development (“F&D”) measured in dollars per barrels of oil equivalent (“$/boe”); and (iv) health, safety and environment (“HSE”) measure of the number of major safety or compliance events. The Compensation Committee and the Board selected a combination of financial, operational, asset management and HSE metrics in order to provide a balanced evaluation of performance of the Company for the year. These measures are focused on incentivizing strong cash flow generation and accretive returns on cash outlays. As a result, the highest single measure is free cash flow generation. EBITDA, general and administrative expenses and total direct lease operating expense were included to emphasize the importance of direct cash flow and cost reduction. Increased total production was selected as a metric for the short-term cash incentive awards because it is key to our growth and success, while proved developed F&D was selected because it is return-focused and less influenced by fluctuating commodity prices than some other metrics. Safety is an important part of our culture, and as a result, HSE performance significantly influences the value of each Named Executive Officer’s short-term cash incentive award. While the focus on free cash flow and returns as opposed to growth differs from many peers, the Compensation Committee and the Board believe the overall short-term cash incentive structure best alignsmotivate our Named Executive Officers to manage our business in order to achieve specific financial, operational and our stockholders. strategic goals that are aligned with creation of stockholder value. Performance is measured on an annual basis relative to pre-established performance criteria.

Establishing 2023 Target Annual Incentive Program Awards

The target levels for each of the financial performance and operational performance metrics were set by the Compensation Committee and the Board at levels that are expected to result in the achievement of the $25.00 MM in synergies announced in connection with the Stone Combination, adjusted for the impact of subsequent acquisitions and organic increases in production. The Compensation Committee and the Board retain the authority to adjust the performance measures or increase or decrease the payout percentage. The weighting of these performance measures, the 2018 Fiscal Year threshold, target and maximum levels of performance for the 2018 Fiscal Year, the actual results for the 2018 Fiscal Year and the payout percentage for the 2018 Fiscal Year are set forth in the table below.

Performance Measure | Individual Weighting | 2018 Fiscal Year Threshold | 2018 Fiscal Year Target | 2018 Fiscal Year Maximum | Actual Results for 2018 Fiscal Year | 2018 Fiscal Year Payout Percentage | ||||||||||||||||||

Financial Performance | ||||||||||||||||||||||||